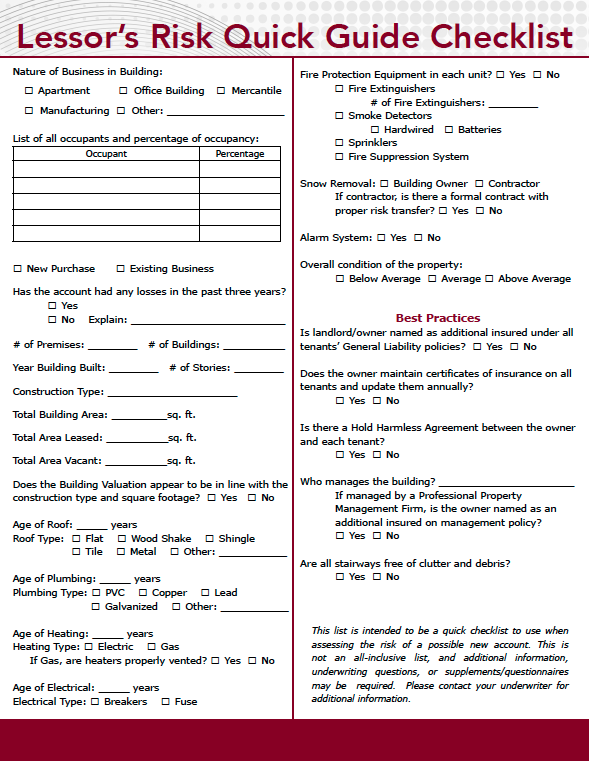

As an agent, you are always looking for “good” risk clients, whether for auto, home, or business. When it comes to Lessor’s Risk accounts, in certain situations, a property may not qualify for coverage. Generally, a good risk includes well-maintained properties with dedicated management and maintenance.

Being a landlord of a building with multiple tenants is a risky business, but a smart owner will take preventative measures to lower this risk. For starters, having insurance on their property and building shows that they are prepared should disaster ever strike. They are prepared for the unexpected and sometimes the unpreventable.

Landlords who put good lighting around pools, stairways, hallways, parking lots, and entrances are concerned about tenants’ and customers’ safety, making them a better risk. Low lighting can encourage break-ins, theft, vandalism, illegal activity, and more.

Talking to tenants about repair requests and the timeliness of the landlord’s response will give you a good idea about the landlord’s maintenance of the property. Do they work to make sure requests are fulfilled in a timely manner, or are they unresponsive to multiple requests from tenants? A good landlord will work to keep their property in tip-top shape and respond promptly to requests.

Putting preventive measures in place is also another way landlords can be considered a good risk. Having items like smoke detectors, sprinkler systems, carbon monoxide detectors, and lighted exit signs, as well as an emergency plan clearly posted, are some preventative measures that indicate a good risk. The more items they lack from this list, the higher the risk they are for claims.

Being able to produce proof of tenants having insurance over their own property shows that not only is the landlord protecting their property but is also making sure that the tenants are protecting their own. This means that the landlord has made it clear that their insurance does not cover tenants’ property, thus making sure they provide their own.

Above all, landlords who have vacancies in their building can create an opening for activity to occur without their knowledge. Also, having a high tenant turnover rate is not a good sign. Vacancies offer up a lot of questions that tend to not have good answers.

Looking into each property with this list in mind will allow you to make a better decision about whether an account is a good risk or not. Landlords missing many of these items are probably not accounts that you (or your carriers) want to write.